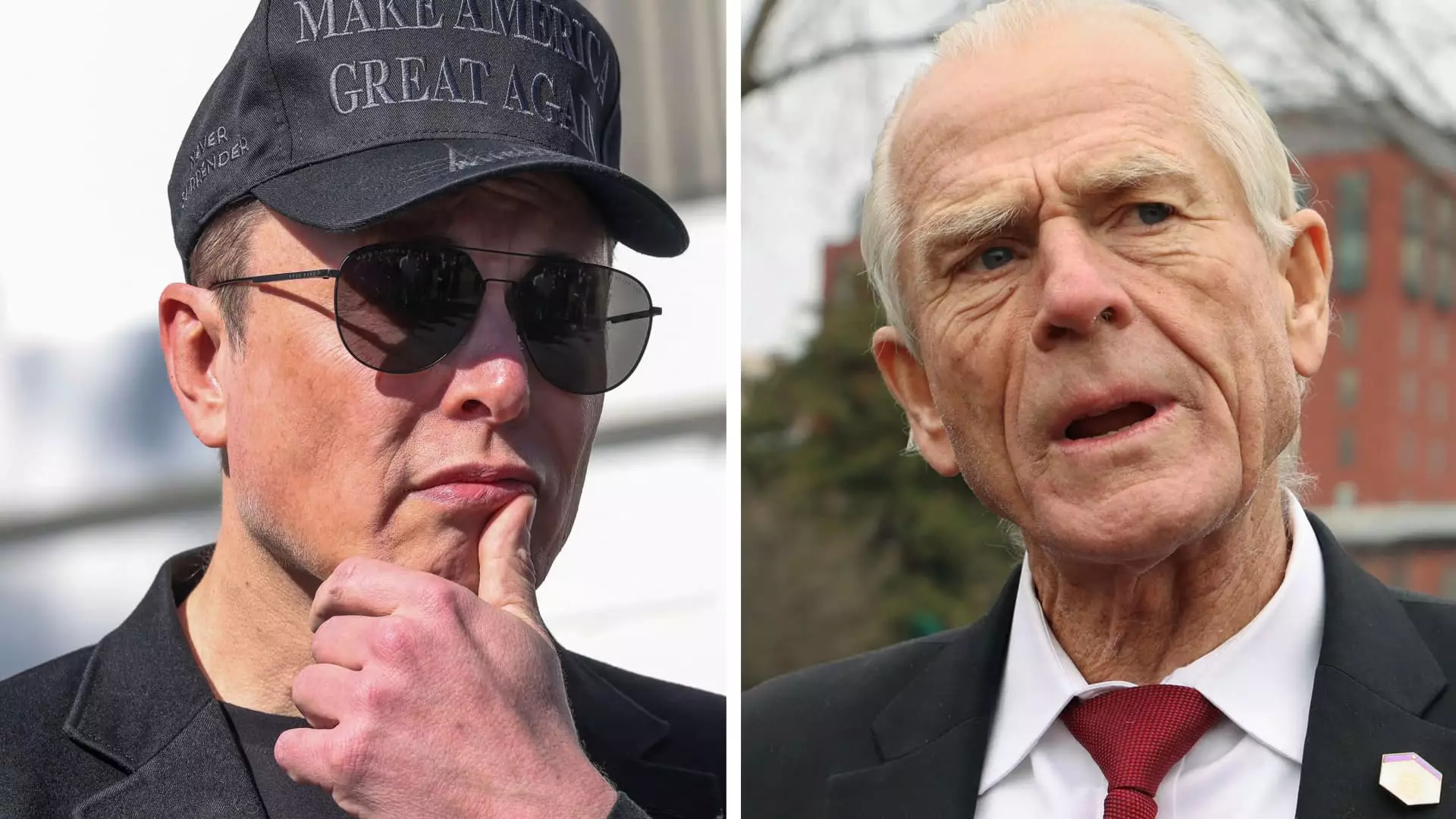

In today’s hyper-connected economy, the lines between politics and business have become increasingly blurred. A striking illustration of this phenomenon unfolded recently as Tesla CEO Elon Musk publicly clashed with Peter Navarro, a key trade advisor to former President Donald Trump. This eyebrow-raising feud comes at a time when Tesla’s stock prices have taken a considerable hit, plummeting significantly over a few trading days. The stakes for Musk are high—not just in terms of financial losses but in how this public spectacle could impact his companies, particularly Tesla and SpaceX.

Musk’s outbursts on social media, where he lobbed insults at Navarro—describing him as “truly a moron” and “dumber than a sack of bricks”—are not mere expressions of frustration. They reveal an underlying tension regarding trade policies that Musk perceives as detrimental to his enterprises. Navarro, advocating for protectionist measures, has repeatedly painted Tesla as merely a “car assembler,” a claim Musk hastily rebuffed by asserting that such rhetoric is not only excessively simplistic but fundamentally inaccurate.

The Fallout from Tariffs

The backdrop to this dramatic exchange involves substantial tariffs announced by the Trump administration, impacting over 180 countries. This aggressive trade posture has raised eyebrows not just within the industry but also among the political elite, highlighting a significant divergence in views: While Navarro argues for robust trade barriers aimed at preserving American jobs, Musk advocates for free trade principles that he believes will ultimately benefit consumers and businesses alike.

Tesla’s challenges are compounded by these tariffs, especially as analysts suggest that the company might not weather the storm as smoothly as initially thought. While it was presumed Tesla, with its domestic assembly in the U.S., would be less affected than competitors, the increasing costs of raw materials and crucial automotive components sourced from overseas complicate the narrative. Canada and Mexico are leading suppliers of steel and aluminum to the U.S., and Musk’s calls for a zero-tariff trade zone between Europe and North America starkly contrast with the prevailing policies of the administration he previously supported.

A Closer Look at the Business Landscape

As Musk’s relationship with Trump’s administration deteriorates, it’s crucial to analyze the financial metrics that bear witness to Tesla’s precarious position. The company saw a staggering 22% dip in its stock over a four-day span, and year-to-date it has lost approximately 45% of its value. This drastic decline culminates in thousands of employees facing uncertainty and millions in paper losses for Musk himself. Such volatile fluctuations serve as a reminder that even the most seemingly invincible businesses can falter under the right—or wrong—conditions.

During a recent event in Italy led by right-wing Deputy Prime Minister Matteo Salvini, Musk expressed his vision for a more integrated market, insisting that both Europe and the United States should strive for freer trade. His perspective emphasizes the contradictions that often arise in high-stakes negotiations where personal interests and broader economic principles collide. Musk’s expansive viewpoint on international trade reflects not only his vested interests due to Tesla’s investments but also a philosophical stance against protectionism, which he believes stifles innovation and growth.

The Broader Implications of Musk’s Feud

The personal animosities between Musk and Navarro draw attention to a larger issue: how individual personalities within political and business realms can significantly influence market dynamics. The spat has garnered media attention not only because of the nature of the insults but also due to their broader implications for the tech and auto industries. This public rivalry illustrates how public figures can reshape narratives and influence investor behavior, often in unpredictable ways.

In light of his recent setbacks—extended protests, boycotts, and negative press—Musk’s confrontation with Navarro may provide a moment of introspection for industry leaders. It begs the question: in an age dominated by social media and instant communication, how do personal disagreements affect corporate strategies and consumer perceptions? As the situations at Tesla and beyond continue to evolve, the answer to that question will undoubtedly redefine modern business practices.

Musk’s narrative, faced with internal and external turbulence, sets the stage for an ongoing saga that not only affects Tesla’s trajectory but could also impact broader economic policies as nations continue to navigate the turbulent waters of international trade. The interplay between Musk’s business acumen and Navarro’s resolute policies exemplifies the complexity of today’s economic landscape, capturing the attention of investors, consumers, and policymakers alike.