In an ever-evolving global market, the announcement of increased tariffs can send shockwaves through various industries. Jason Chen, CEO of Acer, recently shed light on how the 10 percent import tax imposed by the U.S. government on goods from China will likely lead to a price increase on laptops sold in the United States. Chen’s assertion that prices could rise as much as 10 percent due to these new tariffs exemplifies a broader concern among consumers and industry experts alike about the implications of trade policies on essential technologies.

Chen’s commentary indicates not only a straightforward correlation between tariffs and consumer prices but also hints at a potential ripple effect among competitors. His concerns go beyond the obvious price increase, speculating that rival companies may exploit the situation, raising prices even further under the guise of increased costs. Such strategies could lead to an environment where consumers face exorbitant prices, even though the initial price hike was primarily driven by government policy.

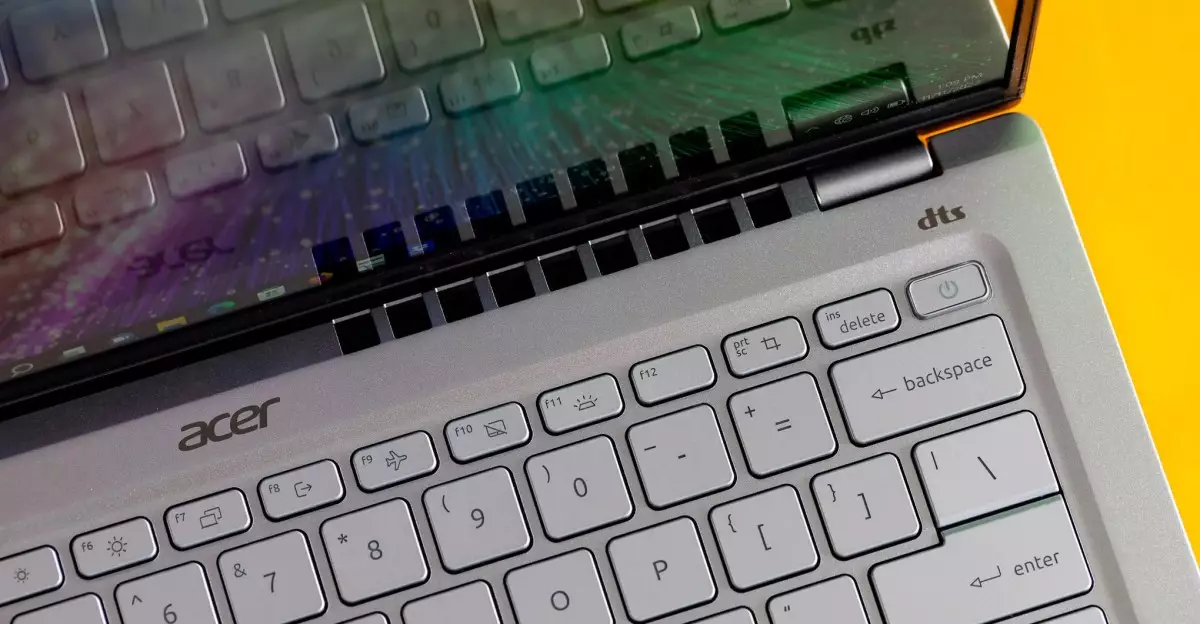

A major factor contributing to the impending price hike is the manufacturing landscape. Most laptops and electronics are currently assembled in China, creating significant dependencies that are difficult to dismantle quickly. Chen mentioned that Acer had previously shifted its desktop computer manufacturing outside of China during earlier trade tensions. Now, as pressures increase, Acer is considering relocating some laptop production as well, with the U.S. being “one of the options” on the table.

This illustrates a key shift in strategy for tech companies: diversifying their manufacturing bases to mitigate risks associated with tariffs. By considering production outside of China, manufacturers not only aim to sidestep taxes but also to enhance their supply chain resilience. While this is a proactive approach, the transition may take considerable time and investment.

The anticipated price hikes are likely to evoke mixed reactions from consumers who are already contending with rising costs in other segments of the economy. With technology being essential for both personal and professional use, many individuals find themselves at a crossroads. Faced with higher prices, consumers may need to decide whether to delay purchases, seek alternatives, or even explore refurbished or older models that may not bear the brunt of the new tariffs.

Although companies like Acer are vocal about their moves, many industry giants such as Apple, Dell, and HP have remained cautiously silent. Their delayed responses could indicate uncertainty or careful strategizing of their next moves, potentially leaving consumers in the dark as they weigh their options. This lack of clarity may create further anxiety among potential buyers seeking transparency in pricing.

The interconnection of trade, tariffs, and pricing in the technology sector is increasingly becoming a topic of concern. As Acer’s CEO outlines a potential future of increased laptop prices, the specter of price gouging looms—a scenario that not only raises questions about corporate ethics but also about the protection offered to consumers. With the manufacturing and supply chain ramifications still unfolding, both consumers and companies will need to navigate an uncertain economic landscape. The choices made in the near future will undoubtedly shape the market for laptops and technology products for years to come.