Intel’s recent 9% decline in stock value signals more than just a routine dip; it underscores deep-seated skepticism about the company’s strategic direction and long-term viability. While the company managed to report better-than-expected earnings—beating revenue estimates and projecting a promising third quarter—the underlying anxieties are starkly evident. Investors are increasingly wary of Intel’s recent announcements, especially its decision to sharply cut foundry costs, which raises fundamental questions about the future of its manufacturing empire. The decline of 60% in stock value in 2024 isn’t merely a reflection of poor market conditions; it is a mirror to Intel’s ongoing struggles to redefine itself amid a fiercely competitive landscape dominated by AI giants like Nvidia and innovative foundry players like TSMC and Samsung.

Strategic Retreat or Necessary Realignment?

At first glance, Intel’s move to curtail foundry investments—scaling back projects in Germany and Poland, and slowing production at Ohio—may appear as a sign of retreat. However, a closer inspection suggests it’s a strategic recalibration born out of necessity. Intel’s foundry ambitions, once viewed as a cornerstone to compete with the likes of TSMC, have not materialized as hoped. The company admits to having struggled in securing external customers for its cutting-edge nodes, including the upcoming 14A process. This acknowledgment reveals that Intel’s long-held dream of becoming a leading chip manufacturer for external clients is slipping from its grasp, at least for now. It’s a bold move to pull back from business segments that have failed to deliver, focusing instead on core competencies and internal demands. Yet, this shrinking of scope adds uncertainty—particularly regarding whether Intel can sustain its R&D pipeline and maintain relevance in a market that moves at lightning speed.

The Challenge of Reinventing a Tech Titan

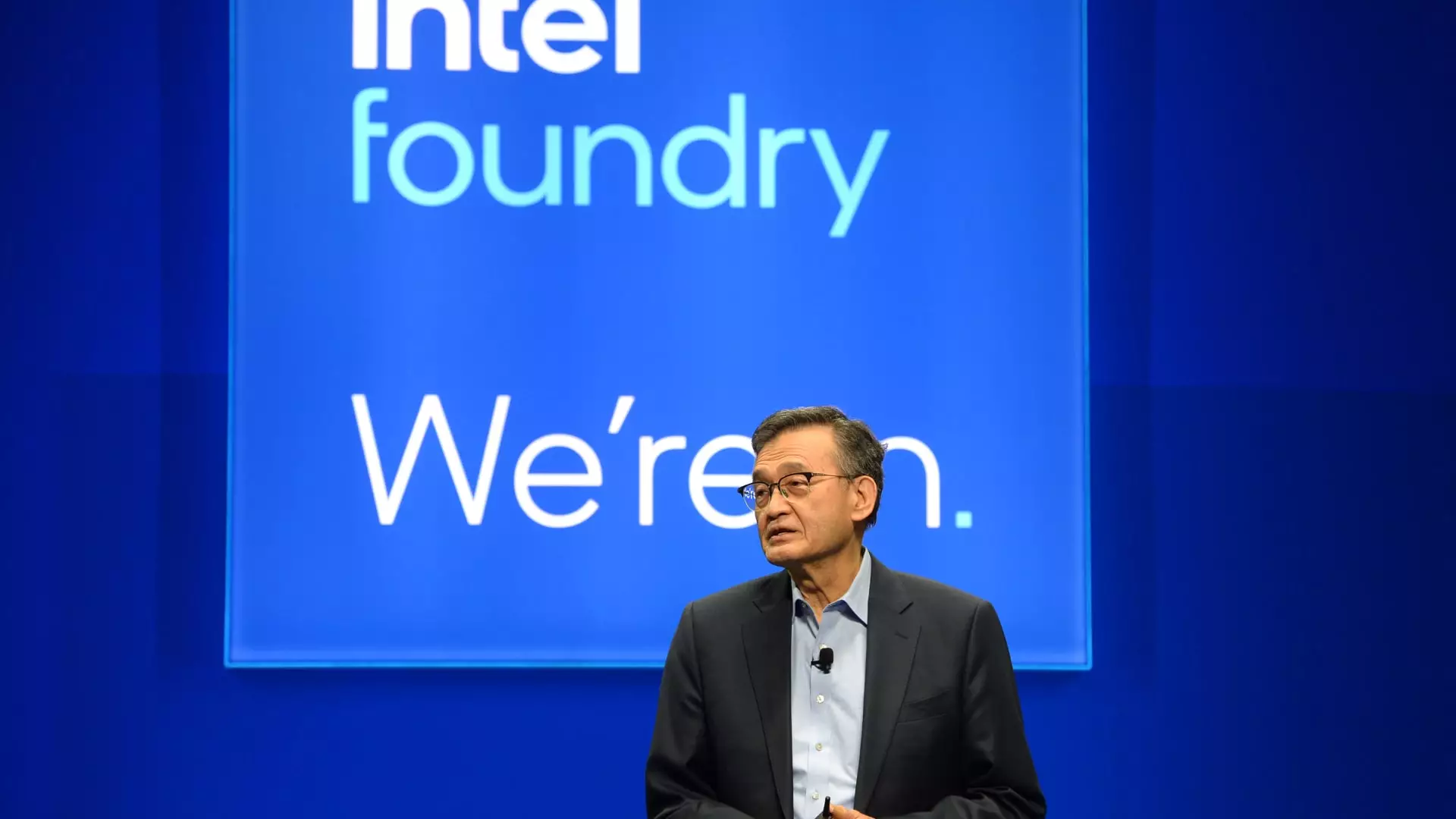

CEO Lip-Bu Tan’s remarks hint at a candid acknowledgment of the uphill battle Intel faces. His comment about “not having more blank checks” indicates a shift away from extravagant investments toward a more disciplined, customer-driven approach. The company’s attempt to build its manufacturing process based solely on confirmed customer commitments underscores a pragmatic, albeit risky, pivot. This strategy might preserve cash and reduce losses in the short term, but it also risks stalling innovation and delaying product rollouts—critical in a market where time-to-market can spell the difference between dominance and obscurity.

Furthermore, Intel’s financial report paints a sobering picture. Widening losses, an $800 million impairment charge, and layoffs that cut 15% of its staff suggest a company desperately seeking a new path. This isn’t merely a cyclical downturn; it’s a fundamental identity crisis. Intel has invested heavily in expanding capacity, only to find that demand hasn’t kept pace. The fragmented factory footprint, once envisioned as a strategic advantage, now appears more like a liability that competes for resources and dampens agility.

Market Skepticism and the Race for Relevance

Despite the company’s resilience, there remains a pervasive skepticism about whether Intel can reclaim its former glory. The AI arena, where Nvidia reigns supreme, highlights Intel’s lagging position. Breaking into high-margin AI chip markets or establishing a reliable foundry customer base has proved elusive. JPMorgan analysts’ cautious optimism about the foundry decision hardly masks ongoing concerns: the company’s market share is eroding, and its technological edge is under threat.

From a broader perspective, Intel’s predicament reveals a profound truth about the semiconductor industry’s brutal pace. The company has been both a pioneer and a victim of its own ambitions. The move to scale back infrastructure investments and focus on core operations might be a step toward survival, but it also risks leaving Intel behind in an era where agility and innovation are paramount. The challenge now lies in whether Intel can innovate from within—leveraging existing design and manufacturing expertise—to reinvent itself rather than merely react to market forces.

Intel’s current crisis isn’t just about dwindling profits or lost market share; it’s about facing harsh realities that demand unflinching self-criticism and strategic humility. The company’s willingness to cut back on ambitions it once championed signals a potentially necessary step, even if it invites additional uncertainty. Success will depend on how adept Intel is at converting these setbacks into opportunities for deeper innovation, stronger customer relationships, and a more disciplined execution of its manufacturing capabilities. If it can harness its vast expertise and renew its focus on competitive differentiation, Intel still has a fighting chance to carve out a renewed legacy in the next era of semiconductor innovation. The question is whether the company’s leadership can navigate this turbulent phase with clarity and resilience—before it’s too late to reverse the tide.