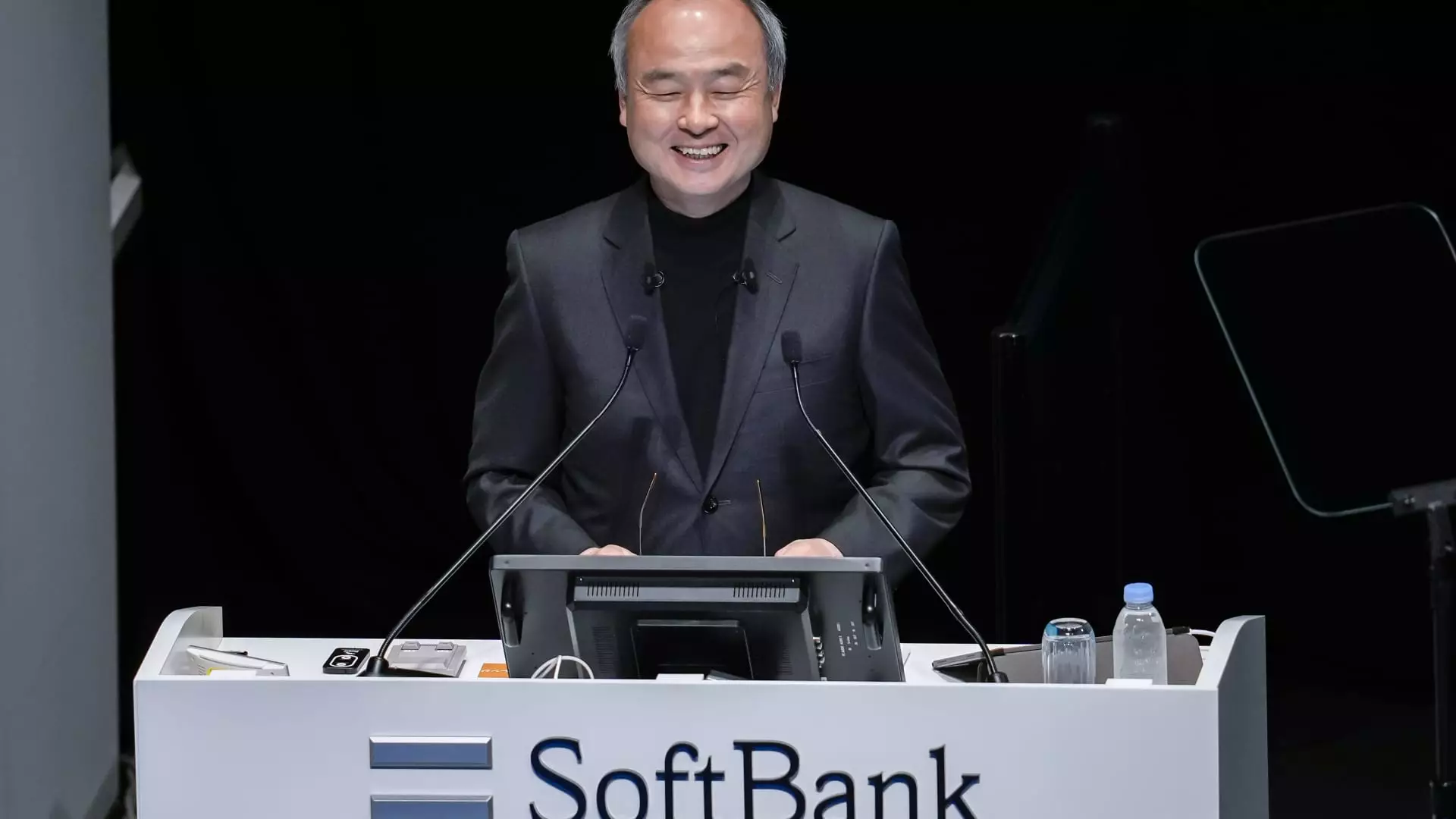

SoftBank, under the leadership of CEO Masayoshi Son, has firmly placed itself at the forefront of the artificial intelligence revolution. This year, the Japanese conglomerate dramatically escalated its investment and strategic engagement with OpenAI, committing a staggering ¥4.8 trillion (around $33.2 billion) to the company. Son’s unwavering conviction that OpenAI will emerge not only as a publicly listed entity but also as the most valuable company globally is a testament to his visionary, albeit risky, approach to technology investment. Unlike traditional investors wary of unprofitable and private tech ventures, Son embraces the uncertainty with boldness, emphasizing that “bravery” is a necessity when pioneering cutting-edge innovation.

Missed Opportunities and Strategic Rivalries

Interestingly, Son’s admiration for OpenAI predates this aggressive commitment. In a revealing admission, he disclosed that Sam Altman, OpenAI’s CEO, had originally pitched SoftBank for a $10 billion investment before 2019. Son was ready to support OpenAI at that scale; however, OpenAI opted to partner with Microsoft instead. Microsoft’s exclusive role as OpenAI’s cloud and computational backbone provided the company with immense technical and operational advantages—advantages SoftBank couldn’t match at the time due to its smaller scale.

However, the once cozy relationship between Microsoft and OpenAI is reportedly under strain. Microsoft is hesitant to approve OpenAI’s pivot toward a conventional for-profit model, highlighting the complexities in balancing innovation, investment returns, and governance structures in the emerging AI economy. Son’s remarks suggest a resolve that SoftBank remains undeterred, confident that it could have been a more aligned partner than Microsoft, even as he acknowledges the latter’s superior resources and brand prestige.

The Ambitious Vision of Artificial Superintelligence

What elevates SoftBank’s involvement beyond a mere financial stake is Son’s grand aspiration for “artificial superintelligence” (ASI)—an intelligence purportedly 10,000 times smarter than human beings. This notion transcends today’s AI applications, aiming for a transformative leap that could redefine industries and society. Son envisions SoftBank not just as a participant but as the towering orchestrator of this coming era—essentially the “organizer of the industry” in the ASI epoch.

SoftBank’s strategy reflects this ambition. The acquisition of Arm Holdings, a key British semiconductor company, and U.S.-based Ampere, a major chip designer, demonstrates a keen effort to control critical technology enablers. By integrating powerful hardware capabilities alongside AI software investments like OpenAI, SoftBank is building a comprehensive ecosystem designed to dominate the future of intelligent computing.

Challenging Conventional Investment Playbooks

SoftBank’s approach is anything but conventional. Many investors shy away from heralding companies without clear profits or public stock listings; yet, Son’s vision ignores immediate financials in favor of long-term transformative impact. His willingness to relinquish part of his investment if OpenAI doesn’t restructure into a for-profit entity signals corporate pragmatism, balancing idealism with financial discipline. Still, Son’s confidence in OpenAI’s potential appears reinforced, not diminished, by these challenges.

Moreover, reports of Son contemplating a $1 trillion industrial complex in the U.S. further underline his audacious efforts to cement an industrial AI hub befitting the scale of the opportunities he envisions. Such a development would signify a dramatic expansion—and intensification—of SoftBank’s AI bets, emphasizing that Son’s ambitions stretch beyond mere partnership into infrastructure and ecosystem creation.

A Visionary with Both Risk and Resolve

Masayoshi Son’s relentless focus on artificial intelligence, particularly through OpenAI and related semiconductor acquisitions, frames him as one of the most visionary yet risk-embracing figures in global technology investment. His optimism often borders on the audacious—a bold gamble not just on AI as a sector but on the future fabric of human intelligence enhanced or perhaps even surpassed by machine intellect.

Critics might argue that SoftBank’s all-in stance on an unlisted, unprofitable company with unclear governance structures exemplifies recklessness. Yet, Son’s decades-long pattern of betting heavily on disruptive technologies—from telecommunications to chip design—suggests that calculated high-stakes gambles are his modus operandi to shape the future. Whether these risks yield the colossal rewards he anticipates is uncertain, but ignoring such visionary ambitions would be a mistake in understanding the future trajectory of AI and global technological dominance.