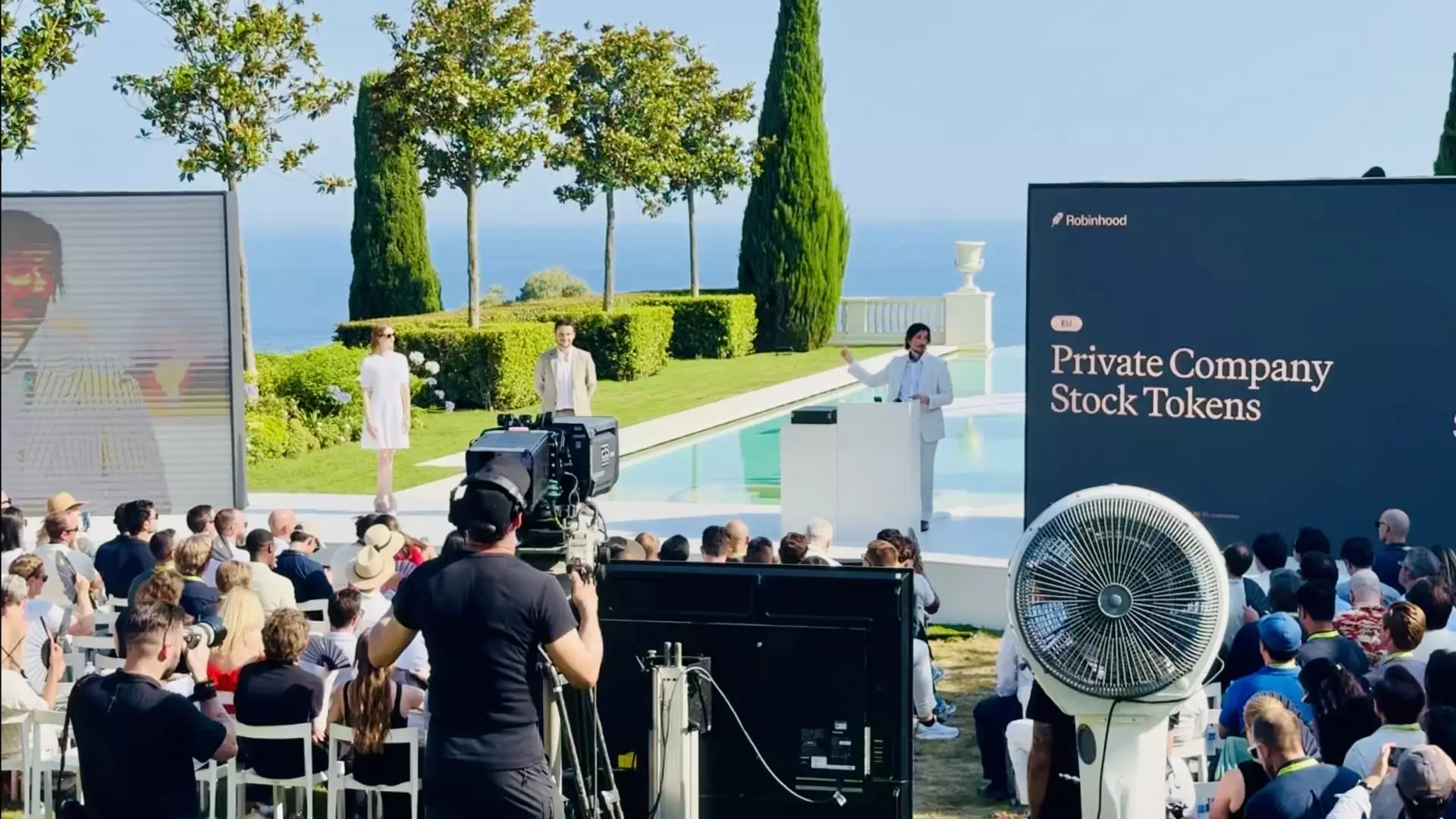

Robinhood’s recent move to tokenize shares of private giants like OpenAI and SpaceX marks a significant inflection point in the evolving landscape of equity investment. Traditionally, investing in such lucrative private companies has been an exclusive privilege, reserved for insiders and ultra-wealthy individuals willing to meet stringent financial requirements. By leveraging blockchain technology, Robinhood is tearing down these barriers, making these coveted assets accessible to a broader audience, at least for European users. This approach not only democratizes investment but fundamentally challenges the entrenched exclusivity of private equity markets.

Why Europe Is Leading the Charge

The EU’s relatively progressive regulatory framework has served as fertile ground for Robinhood’s ambitious rollout. Unlike the U.S., where accredited investor rules erect formidable walls around private equity participation, the EU’s governance allows virtually anyone who qualifies to trade stock tokens to partake in this new market. This regulatory flexibility has empowered Robinhood to test and launch tokenized versions of private company shares, effectively turning private equity into more widely tradable digital assets. It’s a watershed moment that highlights how varied regulatory landscapes can fast-track or hinder financial innovation.

The Power of Tokenization: More Than Just Digital Stocks

Robinhood’s utilization of tokenization signifies more than just the digitization of shares—it embodies a fundamental reimagining of ownership, liquidity, and market accessibility. Tokenized shares of OpenAI and SpaceX become tradable, fractionalized assets with potential around-the-clock trading, no commissions, and minimal spreads—a stark contrast to traditional equity trading, which often involves delays, fees, and barriers. This shift also implies that the ownership “units” can be held, transferred, and managed through blockchain infrastructure, adding a layer of transparency and security rare in conventional models.

Moreover, Robinhood’s introduction of a custodial digital wallet alongside a Layer 2 blockchain built on Arbitrum illustrates a strategic investment into the underlying infrastructure necessary to support scalable, cost-effective token trading. This signals an understanding that the promise of tokenization depends equally on technology integration and user experience innovation.

Marketing Meets Mission: Incentivizing Adoption

To accelerate adoption within the EU, Robinhood is offering a clever and practical incentive: 5 euros worth of OpenAI and SpaceX tokens for every qualified user who trades by a set deadline. This promotional tactic does more than generate buzz—it directly engages users by placing tangible value into their hands and encouraging hands-on experience. Such initiatives are crucial in normalizing tokenized private equity as a viable, mainstream investment vehicle rather than a niche technological curiosity.

U.S. Market: Regulatory Resistance and Optimism

While Europe enjoys the benefits of a more permissive environment, U.S. users remain sidelined from accessing tokenized private stocks. The entrenched accredited investor rules and regulatory caution driven by bodies like the SEC continue to obstruct similar initiatives in the American market. However, Robinhood’s CEO Vlad Tenev advocates for regulatory reform, arguing that blockchain could unlock unprecedented participation in private equity—suggesting that, although delayed, there is potential for future U.S. breakthroughs.

In the meantime, Robinhood’s U.S. operations are expanding crypto-related offerings incrementally, evidenced by the launch of staking for Ethereum and Solana—yield-bearing features previously blocked by U.S. regulators. This measured expansion underscores both the challenges and gradual progress of integrating emerging crypto financial products within the constraints of American securities law.

The Broader Implication: A Paradigm Shift for Equity Markets

Robinhood’s venture into tokenized private company shares heralds a transformative moment in financial markets. This initiative isn’t just a novel product launch—it’s a deliberate disruption aimed at expanding the inclusivity of financial opportunity. By lowering the entry barriers through blockchain-enabled fractional ownership, Robinhood is challenging the exclusivity of wealth-building avenues traditionally limited to a select few.

Yet, the success and sustainability of this innovation hinge on regulatory evolution, technological robustness, and widespread user adoption. The tension between innovation and regulation remains palpable, but Robinhood’s push illustrates a growing conviction that the future of equities—and arguably finance itself—lies in decentralization, transparency, and democratization of access. This daring experiment in Europe could serve as the template that redefines global investment norms in the years to come.