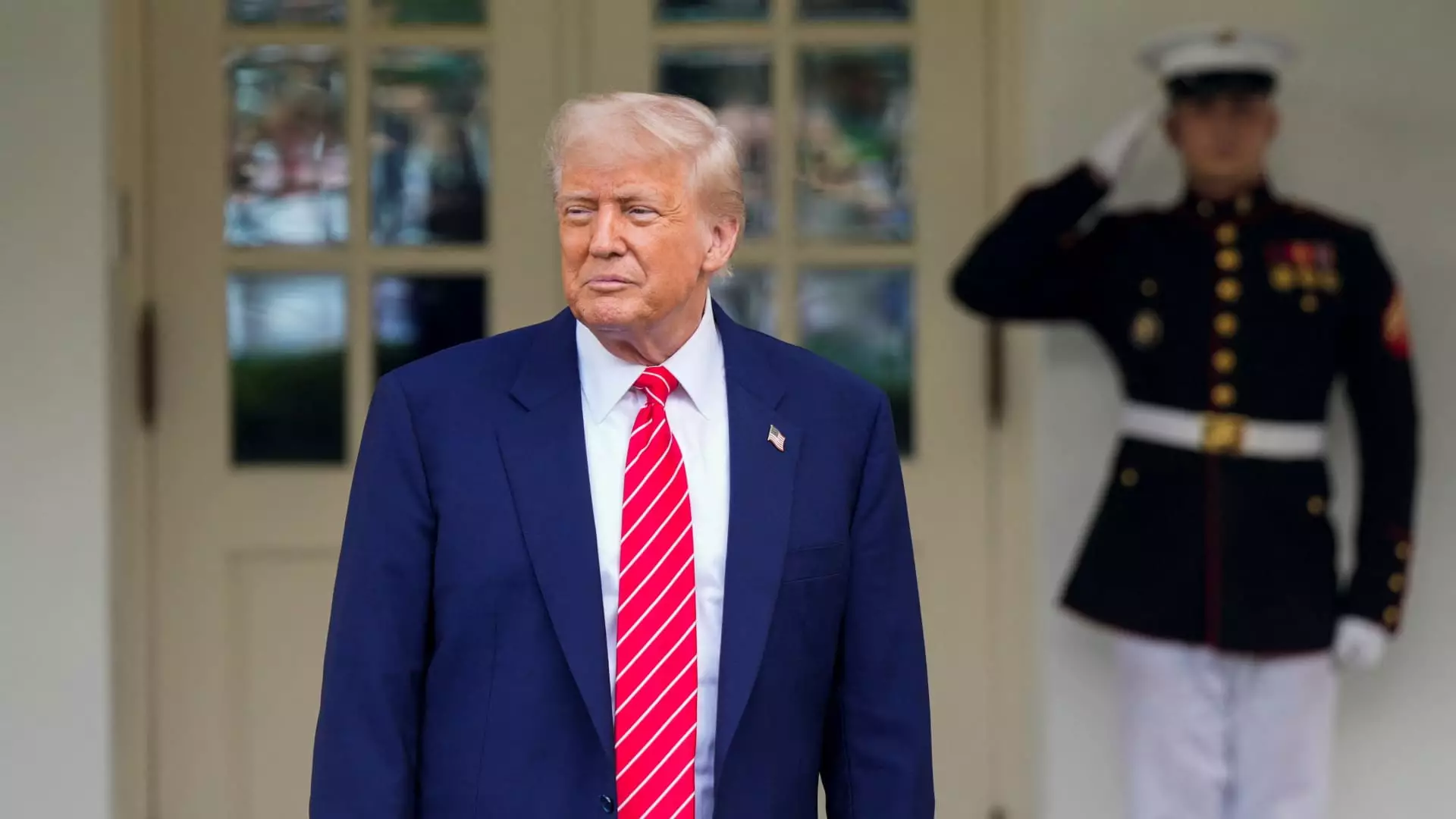

The intersection of politics and cryptocurrency is witnessing a tumultuous phase, primarily instigated by President Donald Trump’s personal investments in digital currency. Recently, the failure of the GENIUS Act—an ambitious piece of legislation designed to regulate stablecoins—can be traced back to anxieties surrounding Trump’s financial entanglements. As lawmakers grapple with potential conflicts of interest, the broader implications for both the crypto industry and legislative progress are profound.

The Conflict of Interest Dilemma

Senator Jeff Merkley’s words encapsulate the prevailing sentiment in Washington: Trump’s involvement in the crypto sector raises significant ethical questions. By intertwining his financial interests with public policy, the President appears to jeopardize the very trust that is essential for democratic governance. The GENIUS Act aimed to create a robust framework for stablecoins, which are digital currencies pegged to more stable assets like the U.S. dollar—a critical endeavor for ensuring consumer protection and market integrity. However, concerns over a “pay-for-play scheme” and the perception of corruption overshadowed its legislative prospects.

This legislative paralysis highlights a troubling trend where personal ambitions supersede the public good. The presence of memecoins linked to Trump, including $TRUMP and $MELANIA, not only question their legitimacy but also cast a shadow on any substantial legislation that aims to guide the future of cryptocurrency regulation.

The Bipartisan Effort Derails

What was poised to be a bipartisan achievement quickly unraveled as various senators reevaluated their positions. Despite some Democrats’ initial support, dissent grew louder as concerns over money laundering, foreign issuance, and national security came to the fore. The bipartisan support that could have propelled the GENIUS Act forward dissipated as influential voices recognized the potential ramifications of passing legislation that could inadvertently support Trump’s financial endeavors.

Senator Lisa Blunt Rochester’s direct commentary on the implications of Trump’s self-dealing struck a chord. The ramifications of intertwining personal profit with public policy not only erode public trust but also threaten national security interests. In a political climate marked by profound polarization, this episode becomes yet another illustration of how personal conflicts hinder the possibility of achieving a unified legislative front.

The Challenge for the Crypto Lobby

For those within the cryptocurrency sector, the implications of Trump’s dealings are both frustrating and detrimental. The crypto lobby, once poised to influence favorable outcomes, now finds itself navigating a landscape rife with obstacles rooted in presidential conflicts. Ryan Gilbert, founder of Launchpad Capital, articulated the sentiment of many industry advocates—personal business interests should not serve as a roadblock to essential policy advancements.

The irony here lies in the fact that the crypto industry, having weathered numerous challenges during the current administration, had found renewed hope in a potential Trump-led framework that might facilitate growth. Yet, with the focus diverted to political maneuvering and personal enrichment, industry stakeholders are left fuming over missed opportunities.

Public and Political Reactions

The public discourse surrounding these events has been charged and revealing. Critics from both sides of the aisle, such as Elizabeth Warren and Kirsten Gillibrand, emphasize the critical need for robust regulations to secure the crypto market and, by extension, the economy. Gillibrand’s assertion that regulatory frameworks must safeguard consumers speaks volumes about the prevailing concern for public welfare, which tragically stands at odds with personal ambitions.

As discussions around the END Crypto Corruption Act gain momentum, Democratic leaders emphasize the importance of separating financial interests from governance. These legislative efforts signal a potential shift towards greater accountability among elected officials, setting a precedent that could reshape the relationship between politics and emerging technologies.

The Global Implications for U.S. Crypto Policy

The ramifications of this ongoing saga extend far beyond domestic legislation. The United States, once a leader in cryptocurrency innovation, risks losing its standing on the global stage if these conflicts remain unaddressed. The potential for declining investment and innovation could reposition the U.S. as a cautionary tale rather than a vanguard.

As Gilbert aptly pointed out, the perception of the U.S. could shift dramatically, leading to reputational damage that stymies international collaborations and stakeholder confidence. The resulting hesitance from global investors could lead to an exodus of capital and talent, siphoning off opportunities that might have cemented the U.S. as a leader in blockchain technology.

Through this lens, the unfortunate entanglement of Trump’s personal ventures with essential legislation becomes much more than just a political misstep; it is a pivotal moment in the evolution of cryptocurrency regulation in America, one that encapsulates the broader struggle between innovation and integrity in contemporary governance.