Nvidia, a titan in the tech industry, is set to announce its fourth-quarter earnings this Wednesday, with Wall Street’s anticipation hovering around adjusted earnings per share (EPS) of $0.84 and a staggering revenue projection of $38.04 billion. This report not only encapsulates the promising performances of one fiscal quarter but also signifies the culmination of a year marked by unprecedented growth for the company. Analysts forecast that revenue for the quarter ending in January will soar by 72%, while the full fiscal year is expected to highlight an exceptional doubling of revenue to nearly $130 billion. This article delves into the intricate web of factors surrounding Nvidia’s current position in the market, the implications of external challenges, and the expectations for the future.

Nvidia’s meteoric rise over the past two years—an astonishing 440% increase in stock value—has been fueled primarily by the surging demand for its graphics processing units (GPUs). These GPUs have become the backbone for artificial intelligence (AI) applications, including major projects like OpenAI’s ChatGPT. With Nvidia firmly positioned as a leader in providing essential hardware for AI development, it’s no wonder they have at times become the most valuable company in the U.S., surpassing a market capitalization of $3 trillion.

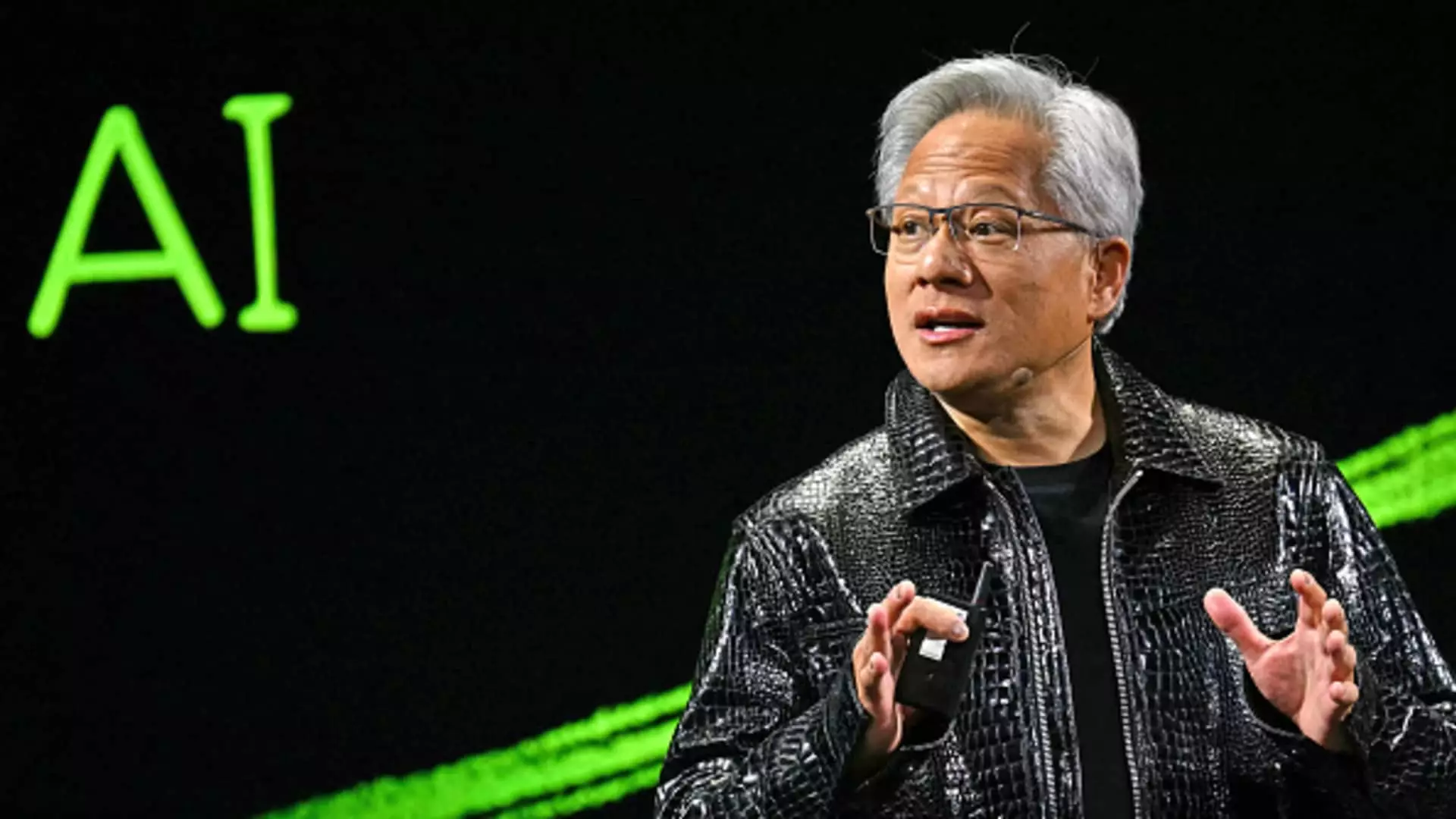

However, amidst this extraordinary growth, there are growing concerns regarding the sustainability of such rapid expansion. Investors are watching closely, with questions about Nvidia’s pathways to maintaining this growth trajectory, especially as the company prepares for a critical earnings call. CEO Jensen Huang’s insights will be invaluable as he addresses investor apprehensions around whether Nvidia can continue to thrive in a rapidly changing tech landscape.

As Nvidia approaches its earnings announcement, a few clouds cast shadows over its growth narrative. Investors are particularly cautious about potential slowdowns from major customers like hyperscale cloud companies, which have historically driven a significant portion of Nvidia’s sales. After years characterized by hefty capital expenditures, market indicators suggest these companies might be tightening their budgets. Compounding these concerns is the emergence of new AI models—such as DeepSeek’s R1—that question the necessity for Nvidia’s GPUs in the development of advanced AI solutions.

The geopolitical landscape adds another layer of complexity. Recent U.S. export restrictions on advanced AI chips to China have left investors on edge about Nvidia’s ability to operate in a crucial market. Undoubtedly, the company’s investments and strategies are impacted by both domestic and international scrutiny, raising questions about future profitability and operational freedom.

A pivotal discussion point during the earnings call will be the rollout of Nvidia’s latest AI chip, Blackwell. Market analysts express varying degrees of optimism—Morgan Stanley’s forecasts suggest major clients like Microsoft will account for nearly 35% of spending on Blackwell in 2025. However, concerns persist regarding potential delays associated with distribution, particularly due to issues around heating and production yield.

Further complicating Nvidia’s narrative are reports of Microsoft reassessing its infrastructure strategies, including slowing negotiations on new leases with private data center operators. This information could signal a broader hesitance in the industry regarding ongoing investments in AI infrastructure. Despite these challenges, Microsoft has reassured that their planned expenditure of $80 billion in infrastructure remains unchanged, which could be a beacon of stability for Nvidia’s future earnings.

As the earnings report approaches, investor sentiment remains a mixed bag of optimism and caution. Key stakeholders will be scrutinizing Nvidia’s relationship with cloud service providers, looking for assurance that their partnerships are robust enough to weather the changing landscape. Additionally, guidance regarding fiscal 2026 will be critical in setting future expectations for growth, particularly in comparison to the previous year’s elevated sales figures.

Nvidia stands at a significant crossroads, with the powerful forces of AI demand and potential challenges influencing its trajectory. While it has experienced remarkable success, addressing investor concerns and maintaining strategic partnerships will be vital as the company navigates the uncertain waters of a rapidly evolving market. As analysts prepare their evaluations, one thing is certain: the upcoming earnings call will be a landmark moment, not just for Nvidia, but for the tech industry as a whole.