The venture capital landscape is in a state of flux, with increasing speculation about the trajectory of U.S. unicorns—startups valued at $1 billion or more—as we inch toward 2025. A recent report from PitchBook and the National Venture Capital Association (NVCA) sheds light on the potential for Initial Public Offerings (IPOs) among these high-value companies, offering a nuanced understanding of the factors influencing market dynamics.

Unicorns have garnered immense attention, not just for their billion-dollar valuations but also for their potential to disrupt entire industries. However, the path to public markets is often fraught with challenges. The PitchBook/NVCA Venture Monitor for Q4 2024 highlights a cautious optimism surrounding IPOs in 2025. One of the key tools supporting this analysis is PitchBook’s VC exit predictor, which employs sophisticated machine learning algorithms to evaluate startups’ likelihood of successful exits—whether through public offerings or acquisitions. This objective assessment aims to move beyond anecdotal narratives and posits a more standardized approach to understanding market readiness.

Despite promising statistics related to financing rounds in 2024, experts suggest that the increased prevalence of high-valuation, early-stage AI-focused investments masks deeper issues within the industry. Challenges like valuation mismatches, driven by earlier inflated funding rounds, complicate negotiations and deter potential buyers. Furthermore, regulatory environment plays an instrumental role in shaping the appetite for large-scale deals, a theme frequently echoed among industry analysts.

Amid rising investment levels, there remains an undercurrent of wariness as VCs confront regulatory shifts. Bobby Franklin, CEO of NVCA, points out that changes in leadership at key regulatory bodies like the FTC and DOJ could potentially alleviate liquidity issues for startups struggling under onerous regulatory burdens. The expectation is that, as these changes unfold, they could foster a more hospitable environment for liquidity events such as IPOs or acquisitions.

As more VCs engage in government discussions, there is a distinct opportunity for the venture capital sector to articulate its pivotal role in spurring economic growth. The outcomes of such initiatives could ultimately influence broader policy measures, including a tax bill currently circulating in Congress aimed at rejuvenating innovation and reinstating tax credits that benefit research and development.

As the report delineates potential IPO candidates among U.S. tech unicorns, several names rise to prominence. Anduril, a defense technology firm founded by Palmer Luckey, stands at the forefront, with a 97% predicted chance of going public in 2025. Another frontrunner is Mythical Games, reflecting the growing traction of the gaming industry in the Web3 space. Others, such as Impossible Foods, SpaceX, and Databricks, are equally vying for attention with high probabilities of entering public markets.

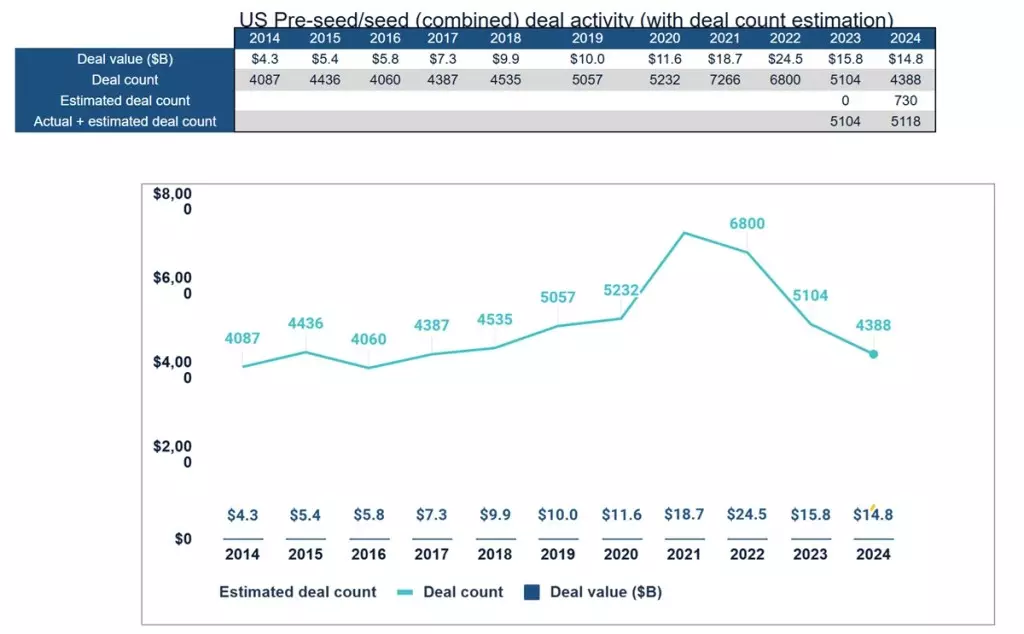

This growing enthusiasm for certain startups contrasts sharply with the broader landscape, characterized by a decline in smaller funding rounds. The number of startups securing between $1 million and $5 million dwindled significantly from prior years—a reflection of the challenges faced by early-stage businesses in securing the necessary capital to scale.

As we look toward 2025, the prospect of U.S. unicorns embarking on their IPO journeys introduces a blend of opportunity and apprehension. The broader venture capital ecosystem is still grappling with the need to recalibrate expectations regarding valuations and deal structures, as the market evolves. Investment strategies may lean towards favoring larger, more established firms, potentially sidelining emerging players who find it increasingly difficult to attract capital.

Furthermore, while regulatory updates could boost market confidence and availability of funds, the lingering uncertainty surrounding macroeconomic conditions remains a pronounced barrier. As venture capitalists and entrepreneurs strive to navigate these complexities, continual adaptation will be crucial for success in leveraging the full potential of the unicorns poised for an unprecedented chapter.

While optimism lingers in the air regarding the prospect of public offerings among U.S. unicorns, the path forward is dotted with significant hurdles that must be addressed, underscoring the need for strategic adjustments within the venture landscape as it anticipates a dynamic future.