Snap Inc. is making notable strides as it gears up to launch a simplified version of the popular Snapchat app in early 2025. During a recent quarterly earnings call, CEO Evan Spiegel announced this initiative, coinciding with an impressive surge in user engagement. As of the third quarter of 2024 (Q3 2024), the platform already boasts 443 million active users, having attracted an additional 37 million users in the last quarter alone. While these metrics present a positive picture, it’s crucial to delve deeper into the financial dynamics and user experience strategies that Snap Inc. is navigating.

Despite announcing a 15 percent year-over-year increase in revenue to $1.3 billion for Q3, the company also reported a significant net loss of $153 million. This juxtaposition of growth and loss speaks volumes about the ongoing struggles within the company, particularly regarding monetization and market saturation. Although Snap Inc. is successfully capturing user attention—evidenced by a 5 percent increase in time spent on the platform—questions arise about sustaining this momentum amid financial headwinds.

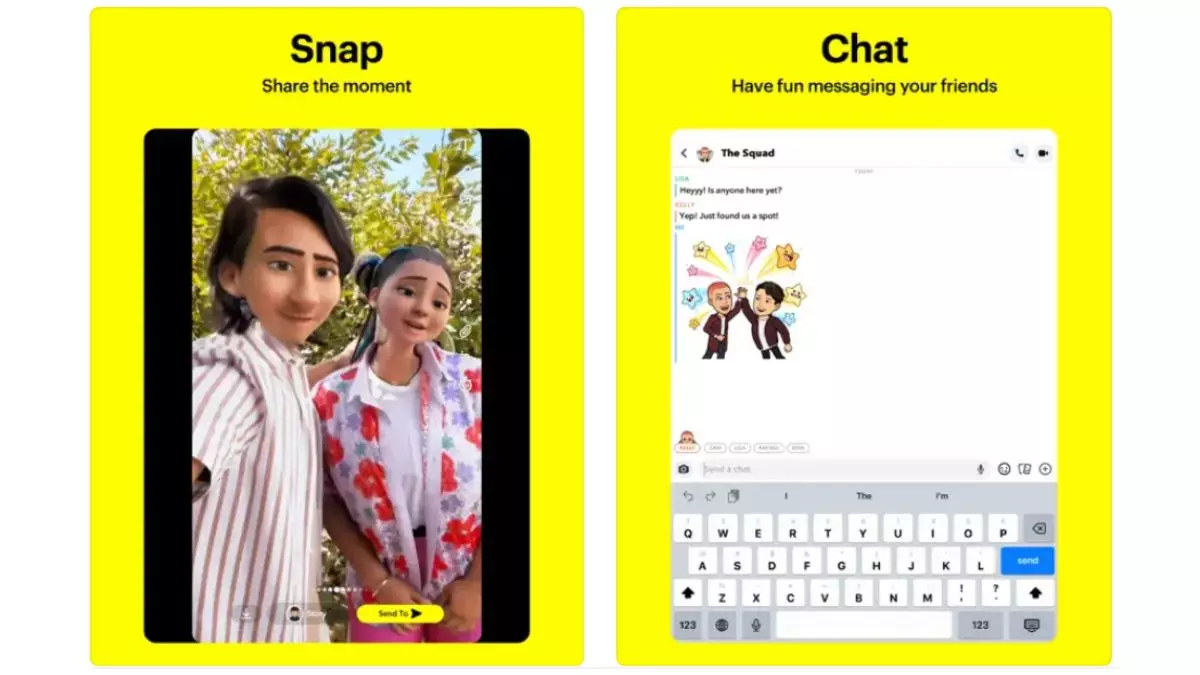

Snapchat has increasingly been perceived as a feature-rich platform with numerous layers that might overwhelm casual users. In response, the forthcoming “simple” Snapchat app aims to streamline the user experience by focusing on core functionalities such as viewing stories and engaging with Spotlight. This new app is currently being piloted with over 10 million users across more than a dozen markets. It is crafted specifically for new or less engaged users, an approach that seems to align with the significant increases in content interaction the company has noted.

In a digital age where attention spans are fleeting, simplifying the user journey can significantly enhance engagement. By reducing complexity, Snap Inc. seeks to attract a broader audience, ensuring that even those who are less tech-savvy can enjoy and interact with the platform effectively. This strategic pivot could very well be a turning point for the company as it seeks to regain footing in segments where user engagement has dwindled.

In tandem with software innovations, Snap Inc. is also enhancing its hardware offerings. The fifth-generation Snapchat Spectacles, which blend advanced augmented reality (AR) capabilities, are set to expand into various international markets, including Austria, Germany, and Spain. This move is significant as it demonstrates the company’s commitment to integrating AR into everyday experiences, beyond just the app interface.

The introduction of Spectacles aligns with the broader trend of merging digital experiences with physical reality, indicating Snap Inc.’s aim to remain a frontrunner in the AR space. By diversifying its product offerings and expanding geographically, Snap Inc. is not just capitalizing on technological advancements; it is also fortifying its brand presence in an increasingly competitive landscape.

As Snap Inc. prepares to launch its simplified app and expand its hardware range, the path ahead is laden with both opportunities and challenges. The balancing act of increasing user engagement while addressing financial losses will be crucial. The simplification effort, combined with the expansion of AR glasses, indicates a thoughtful approach to enhancing user relationships and potentially driving revenue growth.

Ultimately, how well Snap Inc. can execute this dual strategy will determine its future in the ever-evolving social media ecosystem. Keeping an eye on user feedback and market reception will be critical as the company navigates this transformative phase.